Ultimate Guide to Dealership Growth

How to turn challenges facing car dealerships into opportunities to accelerate revenue growth

This past year was full of opportunities for the auto industry to adjust and evolve. Much like the year before, we made the best of our new normals. Vehicle supply shortages and demands for an omnichannel approach to retail and F&I continued to dominate our day-to-day operations, and recruitment and retention of skilled team members remained a key focus. Meanwhile, manufacturers raced toward electrification of their lineups while navigating sourcing battery components.

Despite the potential roadblocks, top dealerships saw great success and achieved record profitability. But how long can this last? With the combination of high interest rates and vehicle prices impacting car sales, more consumers are being priced out of the market.

Even the NADA guiding principles have shifted, taking a stance on the evolution of the franchise dealer model. This is a sign that the way we work must also shift.

As we look to the future of automotive retail, here are a few things to keep top of mind:

Let’s start our journey.

Electric vehicles are starting to enter the car-buying mainstream. While still a small percentage of overall sales for most, this incoming surge presents an opportunity for every area of your dealership. With manufacturers committing to EV at various levels, there’s no one unified approach in the industry. Taking the time now to understand these changes and figure out how EVs can benefit your dealership’s growth will help your team through this transition.

To prepare your dealership, start by collecting key information by which you’ll set your goals. Talk to your team and your customers to understand any questions or hesitations.

As for your dealership operations, consider these questions:

- Can your service drive handle significant process, skill and equipment updates that come with this new powertrain?

- What investments need to be made to create an environment for optimal EV purchasing?

- What should you expect to budget for the hiring, training and retention of EV experts in your dealership’s sales, service and F&I teams?

Incorporating Electric Vehicles and a New Service Drive into Your Dealership

Consumers may have uncertainty when considering EVs because they are newer and there are unknowns about what repair services will look like, and how often they will be needed. A well-staffed and knowledgeable team can be the driving force for a consumer’s decision to purchase, especially as 74% of people say they prefer to buy an EV at a dealership, rather than from a manufacturer or third party.

Remember the basics – the tried-and-true customer service relationship components that lead to retention.

74%

prefer to buy an EV at a dealership, rather than from a manufacturer or third party.

Your dealership needs to present intentional, tailored customer service and stellar follow-through. Regardless of the type of vehicle they plan to drive, customers want to know you care about them and want to earn their business.

Jonathan Jordan

Director of Retail Strategy

JM&A Group

Adapt Your Finance and Insurance for Electric Vehicles

In addition to your sales and service strategy, your F&I department needs to appeal to EV customers as well. F&I coverage needs to factor in the battery and electrical systems and adapt to EV maintenance programs, service contracts and warranties.

It's important to reinforce with your F&I teams the opportunities EVs present to enhance profitability and reduce consumer uncertainties. Data collected from dealership sales of nearly 40,000 EVs from 2021-2022 shows an average PVR lift of $125 over traditional vehicles. And while product penetration remains lower for EVs, especially in service contract and GAP, this is an opportunity to further enhance PVR by increasing overall product sales.

EV vs ICE

Source: JM&A Survey of 1,700 dealerships nationwide

F&I builds customer loyalty, trust and connection to the dealership, so dealers need to excel at creating consistently great experiences. Associates must be trained to expertly and effectively showcase the value of the product offerings, and with EV, there are greater opportunities for sales and F&I to create innovative experiences that build consumer confidence and retention.

Josh Bass

VP of Innovation

JM&A Group

Sharpening these skills now, while EV volume is still relatively low, will greatly impact profitability as sales increase and F&I managers can engage and educate electrified vehicle consumers on products to create more peace of mind.

Some key motivators driving EV customers' F&I product purchases are:

- The need to protect the technology components

- The unknowns of EV maintenance long-term

- The desire to avoid potentially costly repairs

Keeping Traditional vs. EV in Perspective

You can’t open an industry publication or email without reading about EVs. But what’s the reality for today and in the future?

Planning for the future needs to start today, meaning you should be getting your teams equipped for all the implications EVs will have on your dealership’s operations. For most OEMs, EVs still represent a very small percentage of sales, let alone available inventory. But you can expect to see EVs in your service drive soon, if you haven’t already. Product knowledge in sales, fixed ops and F&I will be required for dealerships to remain competitive. Remember, customers today are more informed about their vehicle than ever before, and they’ll expect your teams to know just as much, if not more, than they do.

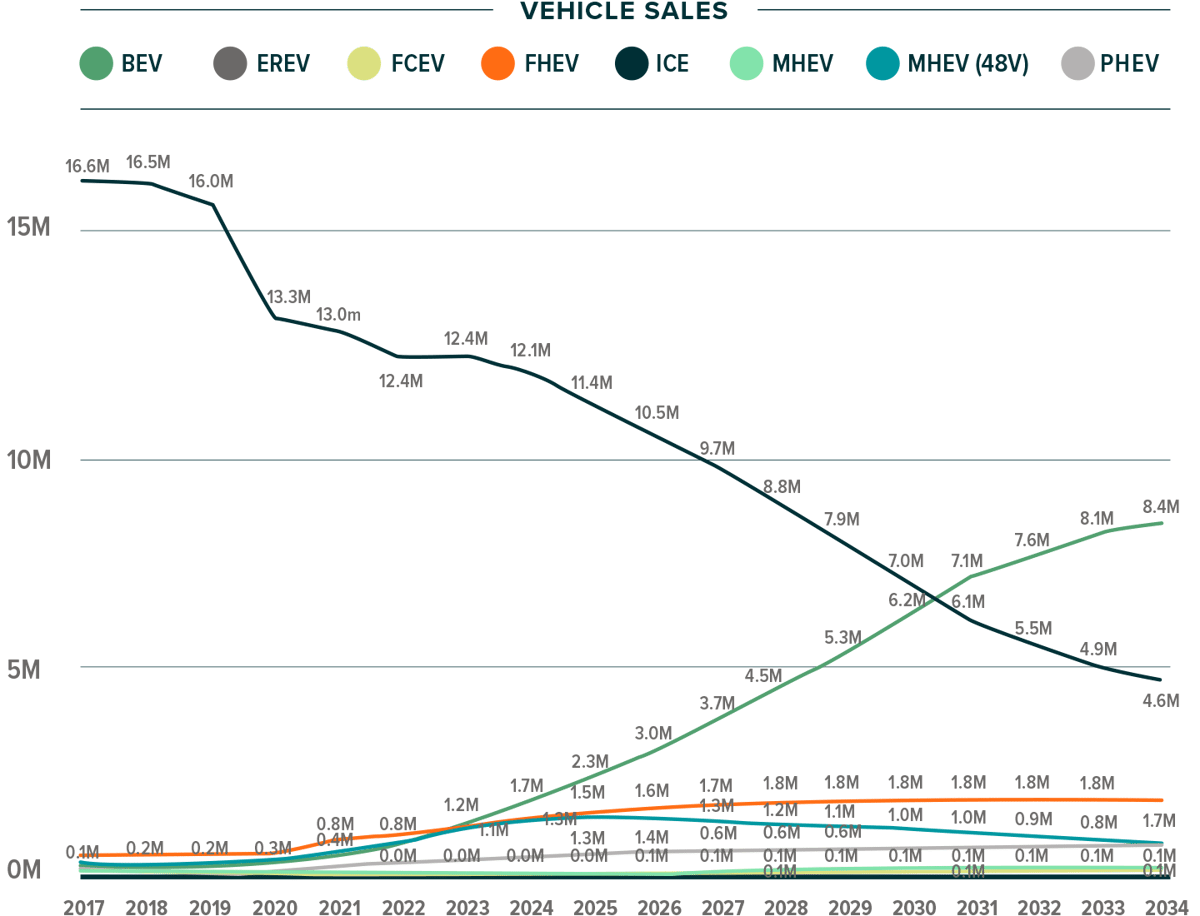

Based on current projections, battery electric vehicle sales will not match ICE sales until 2030.

How to Adapt Your Dealership for Electric Vehicles

EVs will require adaptability and changes across your dealership. Instead of viewing this as a heavy lift, embrace the opportunity for increased profits, as well as a chance to create stronger relationships with new and returning customers. By investing in education for your staff, you can present your dealership as a qualified source of EV information for hesitant consumers, as well as a leader in the industry.

PRO TIPS

- Establish consistent processes for your dealership to adapt to EV in all areas.

- Prioritize attentive customer service and maximize opportunities to educate consumers.

- Differentiate your F&I menu with a branded suite of F&I products tailored to EVs.

- Invest in infrastructure and technology for your service drive to support EVs.

OPPORTUNITY #2

New Car Inventory and Dealership Sales

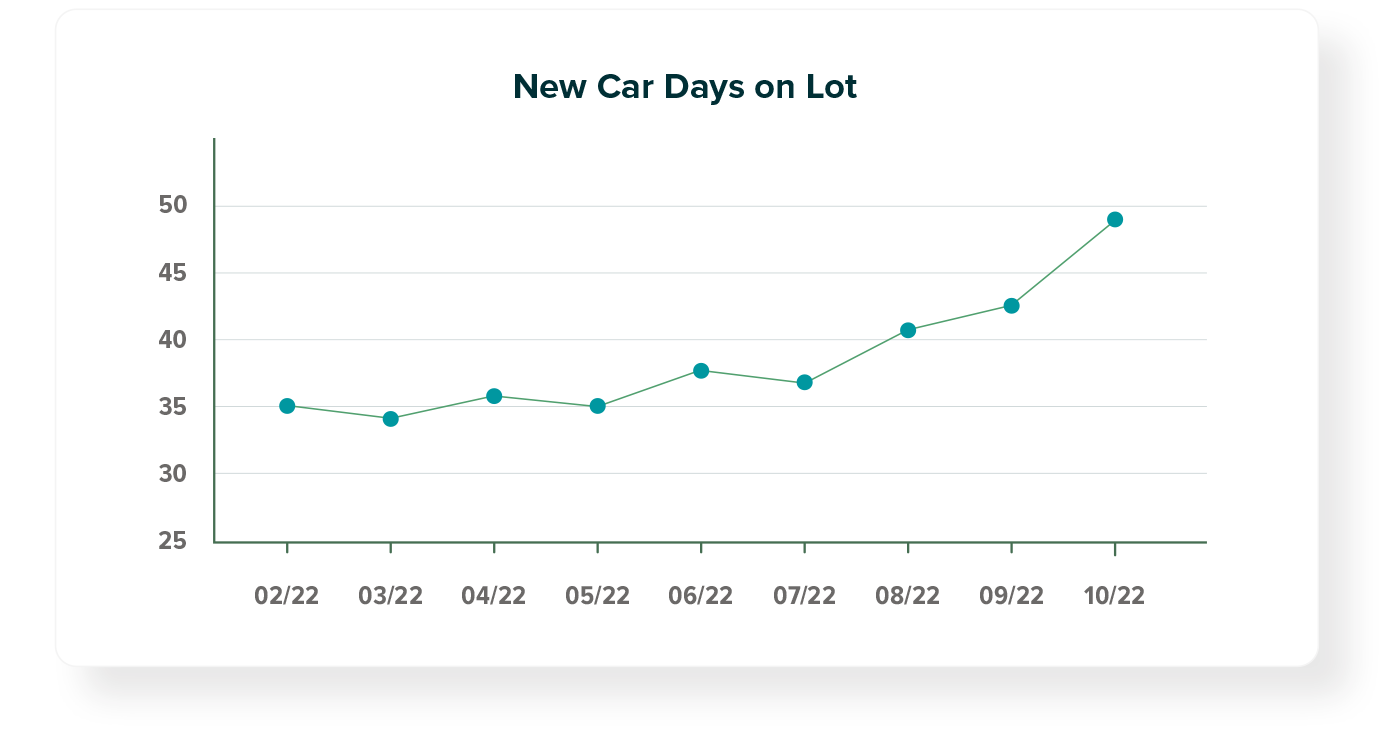

For the past two years, dealers have been asking when vehicle inventory will return to normal. With supply chain challenges and pent-up consumer demand, many dealerships have looked more like empty parking lots than retail operations. This has presented an opportunity for dealerships to focus on F&I and other profit centers with great success, and PVR numbers have reached record highs, but even this wave of profitability has begun to plateau.

Source: Cox Automotive

Thankfully, many OEMs are starting to see the car inventory shortage resolve, but at different speeds. However, with these eagerly anticipated vehicles also comes rising interest rates, which lessens consumers’ desire and ability to purchase and lease cars. And with limited OEM incentives available, dealers have less flexibility to offer promotions to bring customers in.

CONSIDER THIS

14.3 percent of consumers are paying upwards of $1,000 per month for a new vehicle, up from 8.3 percent the previous year.

Source: Edmunds

Dealers can remain competitive while helping to ease many of the economic pressures, enable customers to afford vehicles and keep car sales up by strategically discounting new car prices.

Market Impacts on Used Car Margins

As new vehicle inventory returns, historically high used car prices are inevitably coming down. While that’s great news for affordability, it also means there is a greater gap risk. In many cases, the downstream impact of that is increased contract prices to offset the potential risk, which affects F&I revenue, since customers will be priced out of the higher cost of the contract.

Working with a provider that takes a proactive look at market conditions can mean making smaller, more manageable, adjustments to contract pricing and therefore enhancing earning potential on the front and back end.

How Dealership Processes Impact Profitability

Build-to-order and pre-sold vehicles are still a majority of dealerships’ sales, and as more consumers get used to the ability to order online and pick up their vehicle at a later date, processes need to change to increase profitability. Dealerships must adapt to engage customers earlier to source their financing and sell F&I products. Get the support of your whole team to help manage the balance of loan rates, buyer budgets and dealership profits.

Maintaining a consistent process will be a key element for dealership sales, service and F&I teams. As volume increases and trends shift from the boom of the last few years back to an environment of margin compression, top performers are going back to basics, training and fine tuning the skills needed to ensure future success and dealership profits.

Joe Meininger

Southeast Area Sales Director

JM&A Group

With so many market factors at play in automotive retail, it’s easy to get overwhelmed. Especially considering the peak profitability many dealerships have seen these last few years, best practices may have fallen by the wayside.

To remain competitive and protect your future, you must revisit your processes to maximize revenue opportunities. Know the best financing deals available to your customers, because going the extra mile for them and saving them money on interest rates will often pay off in the F&I office and in customer loyalty.

PRO TIPS

- Prioritize the customer experience at every stage to build loyalty.

- Consider discounting to bring more customers in the door.

- Revisit your processes to align with more modern buying preferences.

As we progress further into the digital age of retailing, consumers are engaging more than ever with multiple online sources during the car-buying experience. And as new competition from used car retailers to digitally native manufacturers enter the market and adopt direct-to-consumer processes, there are more digital retail options vying for limited audience attention. This makes having a solid and compliant online presence all the more vital to dealership success.

Put simply, your competition extends well beyond your physical market and into every direct-to-consumer option, so convenience, ease of use and accessibility matter more than ever before.

Customers have changed and are now more in control of the car buying process. The winners in the battle to maintain dealership profitability and performance will be the dealers that are laser focused on the consumer experience and adapting to the way they want to transact.

Jonathan Jordan

Director of Retail Strategy

JM&A Group

The question on everyone’s mind is: what will the retail and F&I processes look like in the next two to five years and beyond? Several OEMs, for example, have followed Tesla’s model, announcing that they will be moving toward an e-commerce, direct-to-consumer approach, mostly accelerated by the surge in electric vehicles. So, how can dealerships maximize their online presence to educate and engage consumers and turn those interactions into meaningful in-person experiences?

Here are some tips:

Maximize technology’s potential as a customer acquisition tool by ensuring it works seamlessly with your overall strategy, then take it a step further to boost customer engagement and education to support the transaction.

Today’s consumers often enter the dealership with nearly as much knowledge about the vehicle as the sales staff. Get away from the traditional linear sale to empower your teams to create a unique experience for each client.

Don’t implement digital solutions to check a box. Really consider how to use your online resources to efficiently and effectively meet your retail objectives.

Remember that technology is just one piece of the puzzle. Having the right people and processes in place is essential to complete the equation.

Ensure Your Digital Retailing Seamlessly Merges with All Aspects of Your Dealership

What if there was a way to put your top F&I manager in the room for every deal? Implementing centralized virtual F&I is one example of using technology to educate consumers, add efficiency, enhance customer satisfaction and increase profitability. While Virtual F&I is still very new relative to the automotive industry, many dealers have achieved tremendous success in this process.

120

Average Deals per Month

46%

Productivity Rate

In fact, data shows that on average, in-store F&I managers are touching 120 deals per month and operating at 46% productivity. Virtual F&I can significantly decrease unapplied labor, while increasing customer satisfaction and helping dealer performance and profitability to go up. This process allows a single F&I manager to deliver deals across multiple stores at one time, while also helping dealers to stay on pace with changing industry trends and consumer preferences.

Virtual F&I is the Car Buying Experience Customers Prefer

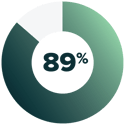

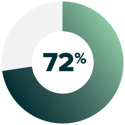

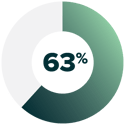

Data shows that 89% of car buyers prefer virtual F&I

Virtual F&I increases customer satisfaction with the buying process by 72%

63% of consumers feel less pressured in a virtual environment

Research indicates that dealers are making more money with customers who are completing their F&I transactions online.

In an interview with CBT News, Jonathan Jordan, Director of Retail Strategy at JM&A Group, reinforced that technology adds value in many ways, but to best leverage it effectively, you must double-down on processes and have the right people accountable for implementing a strategy and technology stack that helps you achieve your goals.

How to Use Digital Retailing to Stay Relevant in Automotive

Implementing a full-service, customer-centric operation across multiple channels will help dealers compete in an industry where consumer options are limitless.

To address modern consumers’ preference for an omnichannel approach, you must assess your dealership’s technology and ensure a smooth and frictionless overall experience.

Above all else, focus on building relationships with your customers by meeting them where they are, maximizing the retail transaction through any channel and any location that the customer wants to do business.

PRO TIPS

- Update your website for the best user experience to create a seamless online interaction that considers every step of the transaction – through and including F&I.

- Train your team to remain compliant when dealing with omnichannel transactions.

- To truly meet customers where they are, all aspects of the dealership experience need to be available digitally and communicated well to potential customers, not just the latest vehicle offers.

- Digital video is a great strategy to engage with your shoppers and complement the shopping journey as well as your paid media strategy, including TV, social media and digital ads.

Average annual employee turnover at U.S. car dealerships fell to 34% last year, the lowest recorded level since NADA has been publishing its Annual Dealership Workforce Study. This record retention is due in large part to already lean staffing and unprecedented earnings resulting from ongoing inventory shortages and limited retail incentives. As those levels begin to normalize, the industry faces the challenge of holding on to top performers who will begin having to work harder to retain their income.

Annual employee turnover at car dealerships fell to

34%

last year, the lowest recorded.

Even in good times, recruitment and talent optimization need to remain a focal point to ensure dealership success.

Kevin Hull

Director of Training and Sales

JM&A Group

Recruiting the Right People for Your Dealership

Your dealership is a brand. It needs to be showcased and marketed to the public to earn new business. The same is true for your brand as an employer to potential applicants and future leaders. Viewing employment as a product can help modernize your recruitment processes and market your open positions in the same way you advertise your vehicles.

Only looking for individuals with automotive experience is no longer a best practice. Skillsets from other industries, especially hospitality, where people are trained to provide exceptional customer service, can have hugely positive impacts in automotive.

Retaining Your Top Performers

Once you find a top performer, retain them by investing in them through ongoing training and one-on-one support, as employees who are more confident in their work tend to stay longer. Training your people on how to be customer-centric and overcome objections can build their core competencies and increase profitability.

And while industry factors may ultimately mean people make less money, it doesn’t necessarily mean you’ll be looking for a new person to fill an open role. Research shows that money is not the primary motivator for employees when they consider their employer. Flexibility and schedule have been found to motivate employees to be more engaged in their work, as does culture and workplace dynamics.

How to Impact Your Bottom Line by Focusing on Your Existing Staff

Many of the profitability challenges dealerships face are rooted in talent problems, which is why dealerships need to take a scientific approach to their staffing.

Using behavioral assessments can improve the talent selection and optimization processes. These tools can help identify the right individuals for the right jobs and, once they are in place, build employee confidence in the aspects of their jobs for which they are best suited, combat turnover and optimize existing talent.

Incentives beyond money can also build loyalty.

This could be accomplished through effective onboarding, which clearly defines the company’s core values and mission, and by cultivating trust and a positive company culture that is built from the top down. Employees should understand what is expected of them and have a clear road map of how the company is going to help them achieve those goals. Through this methodology, your recruiting efforts can result in increased retention and engagement among your teams.

PRO TIPS

- View employment as a product that can be marketed.

- Consider what, beyond money, motivates and engages your candidates.

- Develop programs to build talent and invest in training and development at all levels.

5 Pathways to Increase Dealer Profitability

With a number of trends driving change across the industry, dealers must use the resources, skills and creativity of their teams to meet those challenges head-on and turn them into opportunities to grow and differentiate. Every department must find ways to innovate and continue putting the customer experience at the heart of every interaction.

An important watch out: By looking at your dealership as distinct and separate areas, you could create silos and segmentation, which can limit progress rather than enable it. Instead, the best path forward is to think of your store as a holistic entity where processes and talents can be aligned across all areas of your business as a complete and repeatable cycle.

This way, sales, service and F&I can play an active role in the process, cross-train and find efficiencies. You’ll find the result is an engaged workforce that values and understands the role each person brings to the bigger picture, earning your dealership more revenue and greater customer satisfaction.

To effectively make this change, dealerships should focus on these 5 pathways to profitability:

In the last few years, F&I has seen growth in ways the industry has never seen before. The trends we covered above played a huge role in dealers’ ability to earn more profit on the front- and back-end of each deal, further cementing the F&I department as a core revenue driver for dealerships. However, as we begin to shift back to a more normal state of operations, it’s important to consider what that will mean for F&I to keep it an enduring profit center.

Key Factors in F&I Success

Building a sustainable F&I program requires aligning your goals and success metrics with flexible but focused solutions.

Key areas you should evaluate to ensure you’re maximizing F&I profitability include:

Customer-focused experiences – implement modern retail strategies to evolve with consumer demands and expectations, including Virtual F&I

Ongoing training and support – identify opportunities for growth and achieve your objectives with advice and guidance from F&I experts through automotive F&I training

Deal structure and wealth planning – build your business for the future by making the most of your portfolio, commissions and incentives

Process enhancements – design and implement processes to boost performance, efficiencies and compliance at your dealership

Product mix and menu options – a complete and customer-centric menu for new, used, leased and EVs can help add value to each deal

How to Improve F&I Performance

With so many areas to review and optimize, relying on an experienced partner to help evaluate your dealership processes, goals and key F&I performance metrics can go a long way in accelerating your growth opportunities.

There are a significant number of factors at play when you think about F&I performance, some within the dealer’s control like processes, culture and talent, and others outside their influence like market conditions and OEM dynamics. Making measurable and lasting strides in your dealership’s operations requires taking a holistic approach that drives customer loyalty, motivates your teams and provides flexible and comprehensive options to the dealer and the consumer.

Ian Hunter

Assistant Vice President of Sales

JM&A Group

A good starting place when thinking about F&I is to determine how you are tracking against industry trends of key F&I metrics such as PVR, PPD and penetration on core products like service, maintenance and GAP.

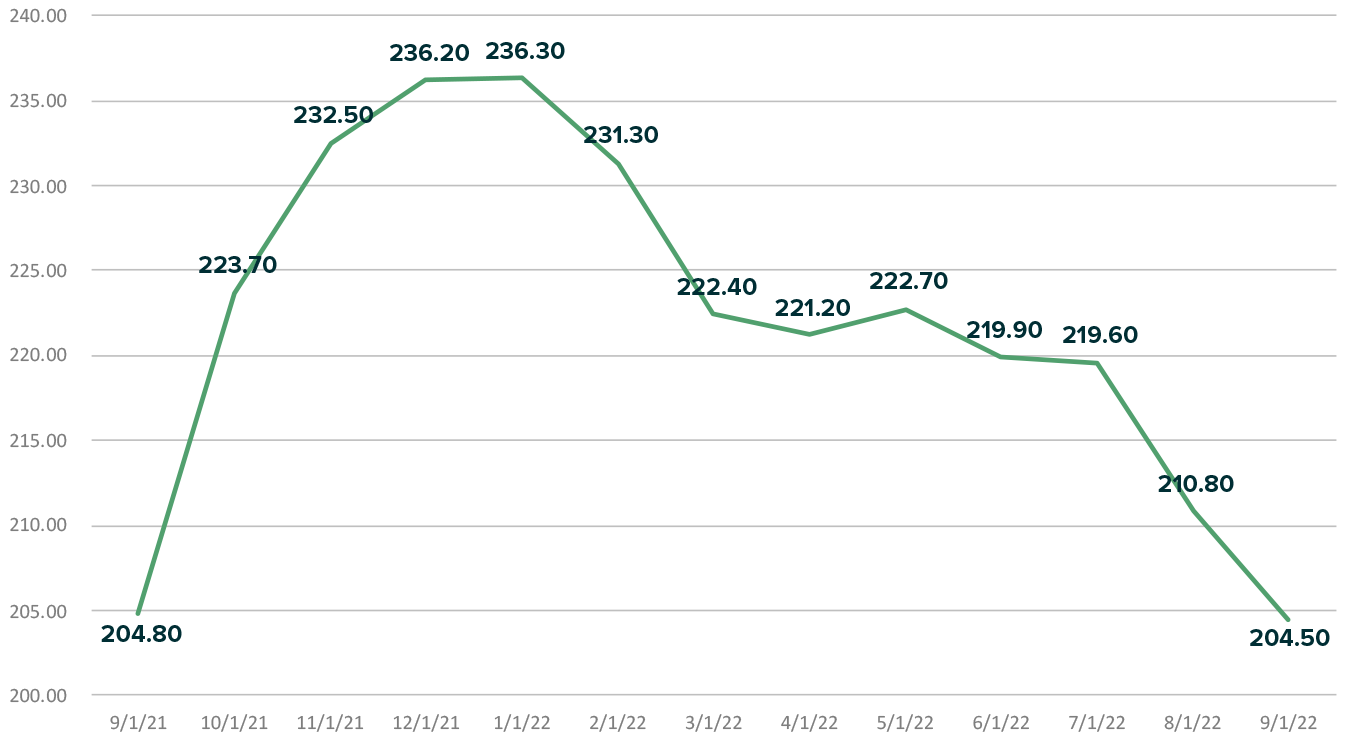

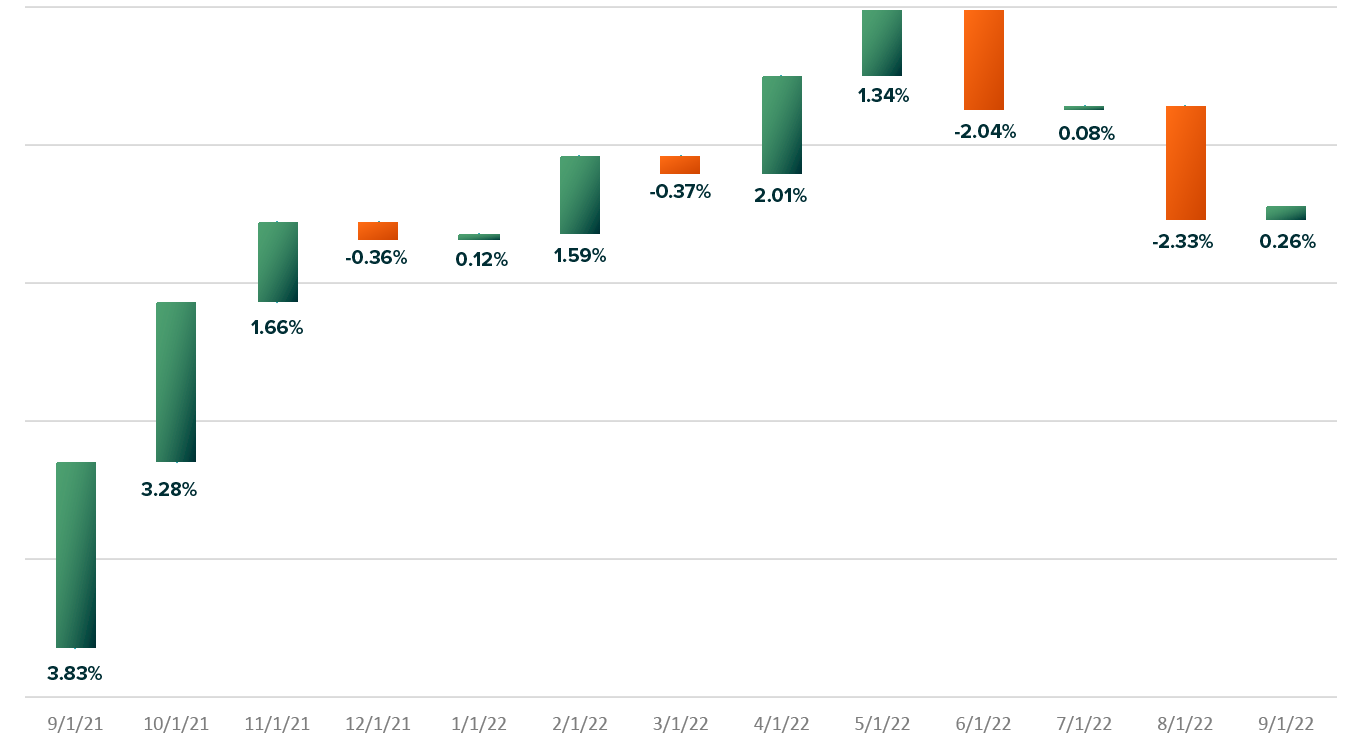

F&I PVR

Source: JM&A Group Automotive Trends Report

While you may see PVR level off compared to last year’s performance, there’s no cause for alarm. What you should be mindful of when looking at these trends is identifying opportunities to increase product penetration and PPD in order to maintain overall F&I gross as the industry regulates.

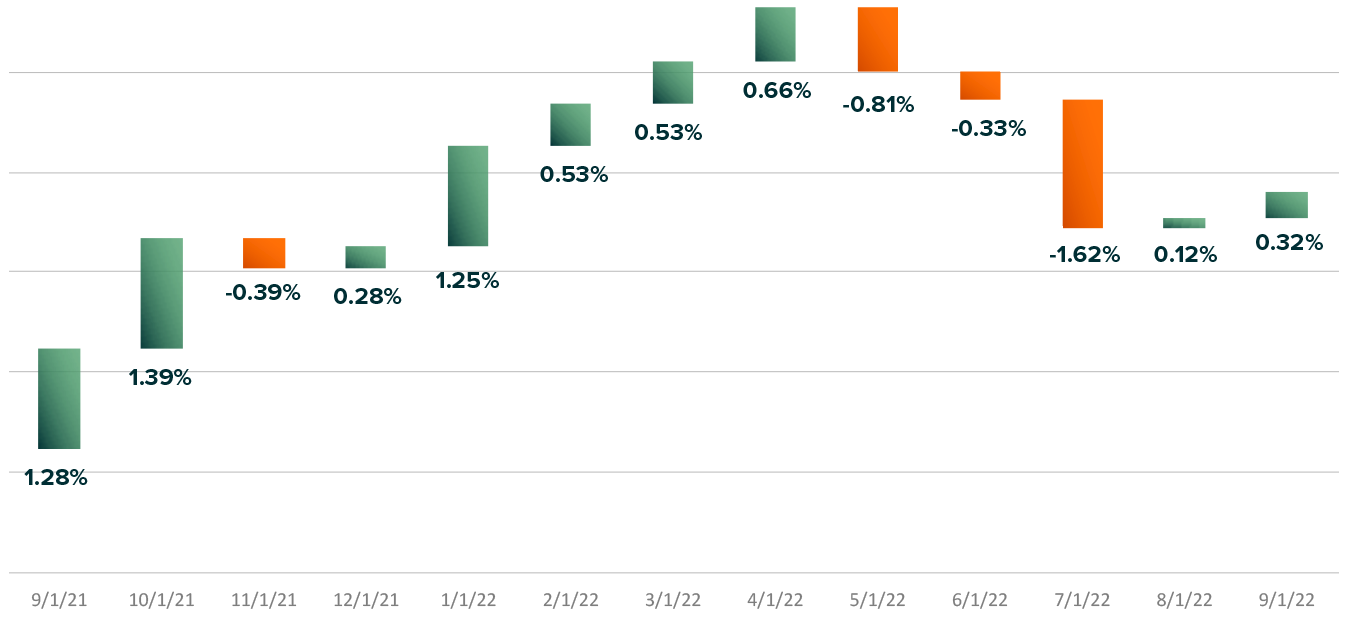

PPD

Source: JM&A Group Automotive Trends Report

The Importance of Having the Right F&I Provider

Having a partner that understands your unique market and business needs and has the tools and experience to help you build a sustainable program can help keep your numbers moving in the right direction and plan for your long-term growth, even as the markets shift.

PRO TIPS

An F&I provider should offer specific, hands-on approaches to help you achieve your goals, including:

- Build relationships and earn trust with your teams and leaders

- Create custom processes to enhance performance

- Provide transparent reporting to track key metrics

- Support omnichannel retailing efforts

- Contribute to your overall financial success

F&I is changing, and dealers that evolve with it will outperform their competitors on conversions and customer loyalty. To continue on an upward path, you must grow and transform your offerings to flex with customer needs and buying preferences.

PATHWAY #2

Find Revenue Growth in Fixed Operations

Most dealers focus their time and efforts on front-end sales, but equally as important is your dealership service department processes. As you consider your growth goals, your dealership fixed operations should continue to be reviewed and assessed as a revenue driver. But no matter what area of your business you’re looking at, it should always be through the lens of your customers.

Quality Customer Experiences in the Dealership Service Drive

Improving customer satisfaction is extremely important for strengthening your dealership’s fixed operations revenue potential.

Customers are looking for transparency and they’re not looking at pricing as much as they’re looking for a frictionless customer experience.

Craig O'Hare

Director of Fixed Ops and Curriculum Strategy, JM&A Group

Communication is a simple but important factor that can go a long way for your customers, earning you trust and improved CSI. Providing your customers with personalized updates while their vehicle is being serviced, backed up by qualified, efficient and personable service advisors, will help differentiate your dealership’s service drive from the other repair facilities down the street and bring you repeat business and referrals.

ASK YOURSELF

- Do you have the processes and digital tools in place to offer your customers personalized service updates?

- What investments in technology and equipment will better enable you to serve customers in today’s environment?

Ways to Reduce Turnover in the Service Drive

As we navigate a shortage in technicians as well as vehicle parts, thinking about how your dealership can best serve customers while also retaining your existing team in the service drive is particularly important.

To help you balance being understaffed while needing to meet the high volume of vehicles, here are two suggestions for boosting capacity on your fixed ops team:

- Offer bonuses for technicians and service advisors who work extra hours, weekends or take a new shift to help you support demand in your service drive.

- Create a recognition program for your team and acknowledge their efforts (even a simple thank you!), and encourage your leadership team to participate – it goes a long way for employee satisfaction and retention.

Everybody always thinks it's always paid driven. It's really not. Employees just want to be recognized for what they contribute on a daily basis to getting the vehicles done on time, keeping the customers happy, getting the parts in as well as helping make a profit for the dealer.

Craig O'Hare

Director of Fixed Ops and Curriculum Strategy

JM&A Group

Navigating Inventory Shortages and Aging Vehicles

In a time of high costs for new and used vehicles, consumers are holding on to their current cars longer, which means aging components will need servicing. Understandably, these can become costly for customers, which may deter them from getting necessary service. Follow up with consumers who decline servicing, by “giving them options of how you can build out a plan to get their car up to manufacturer’s specifications,” says Craig.

Showing your customers you can help them achieve a longer lifespan for their vehicles will help create loyalty and trust. Be transparent and upfront about why your team is suggesting repairs, and why the consumer will benefit from these repairs today and in the future. It will pay dividends for the customer and for you – especially as 74% of buyers who receive service where they bought their cars say they’re likely to buy their next car there, according to a Cox Automotive fixed operations study.

74%

of buyers who receive service where they bought their cars say they're likely to buy their next car there.

Adapting Service Drive Processes for Electric Vehicles

As electric vehicles continue to enter the industry, your service drive will have to adapt to the ever-evolving parts – especially how your dealership will offer maintenance and service and retain customers who favor this new powertrain. It is a big shift that will require financial investment as well as specialized training and equipment as sales volume continues to increase over the next several years. To be set up for success, dealers need to be preparing their service drives now, and having the insights and expertise of specialized consultants can help accelerate that preparation.

We don’t just tell people what to do, we show them how to do it. Then we can develop service directors and service managers and look at the key performance indicators they need to be paying attention to.

Craig O'Hare

Director of Fixed Ops and Curriculum Strategy

JM&A Group

A personalized approach to your dealership service strategy that aligns with your business goals will help boost revenue, strengthen processes and grow your dealership.

PRO TIPS

- Increase your focus on customer service and transparency.

- Review and refine methods for employee retention and loyalty.

- Assess your dealership’s adaptability to EV in the service drive.

Especially in areas of automotive evolution, working with a partner that offers comprehensive dealership support and guidance can make a big difference for your dealership as a whole. Fixed operations, sales and F&I need to work hand-in-hand to create a successful, cohesive dynamic for your staff and customers.

PATHWAY #3

Dealership Training and Development Opportunities for Your Leaders and Teams

Given how fluid the automotive industry continues to be, it’s clear by now that the only constant is change. So, to keep your operations agile and your teams at peak performance, you must prioritize ongoing training and development courses at all levels of your organization. Modern, effective training is much more than a one-size-fits-all approach, and it must also extend beyond finance and insurance training and automotive sales training. Curriculum must advance and adapt with the realities of the dealership and customer of today.

What Kinds of Dealership Training Programs are There?

Today’s environment requires flexibility, and thankfully there are a number of participation options available to those seeking dealership training courses, so you can select what best suits you and your teams.

Just as important as how you’ll receive your training is when and where. Onsite training programs can offer comprehensive services with all the resources available in one place, while regionally based training courses are a great option to reduce the time and expense of travel. Having access to an online calendar of dealership training courses can help you plan and budget for your team’s development opportunities.

30%

Lateral moves and stretch assignments can increase engagement by up to 30%

Plus, aligning training to your dealership’s growth goals for the year ahead will keep your teams engaged and connected to the overall vision for the future.

Talent and strategy should be seen as channels that are firmly linked in your dealership growth plan. Successful companies will coach, develop and cross-train their employees in a way that enables them to leverage their strengths and connect them to long-term business goals. Data shows that investing in training your team provides significant ROI – even before promotions occur, lateral moves and stretch assignments can increase engagement by up to 30%.

CONSIDER THIS

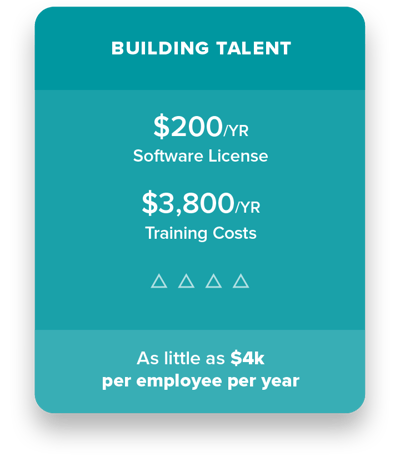

An annual training budget of $3,800 per person drives an improvement in customer satisfaction, productivity and employee tenure. Sounds like a win-win.

Effective Cross-Department Training

Creating a vision everyone can rally behind is a challenge many dealerships struggle with, but achieving that goal begins with ensuring your teams are aligned and accountable – and that starts with leadership. Knowing your strengths and areas of opportunity is the basis for a strong dealership training program with long-term payoffs, including increased profitability and employee retention.

With leadership buy-in and built-in accountability, you increase the likelihood that concepts in the curriculum make it into practice, boost your teams’ skills and performance, and keep them as skilled, engaged employees at your dealership.

Kevin Hull

Director of Training and Sales

JM&A Group

With the support of an established provider with broad offerings covering many areas of the dealership, you can develop a customized training program. A skilled facilitator can recommend course work and design curriculum to suit your team’s needs so your leaders can champion training efforts and hold teams accountable for applying their learnings to their goals.

Hands-on Training Beyond the Classroom

Your people are the heart and soul of your business and your competitive edge. To help keep their skills updated, offering advanced training that follows them from the classroom and into the service drive, on the sales floor and in the F&I office is the next step in their development. In these real-life situations, your team can receive side-by-side support and help align skills to key metrics like customer satisfaction and PVR.

With the number of options available in the training space, make sure you select a training partner that can offer not just variety, but breadth and depth in curriculum that’s suited to your goals for sales, fixed ops, F&I and most importantly – compliance – in the evolving world of data protection and security measures. And, if you’re looking to build an in-house training program, you can also find providers who will create it alongside you with your brand, core values and mission in mind.

By working with a provider that takes an intentional, comprehensive look at your business and has expertise in all areas of dealership operations, you can retain and grow your teams’ skillsets and increase profitability across key departments.

PATHWAY #4

Attracting and Retaining Employees Drives Dealership Success

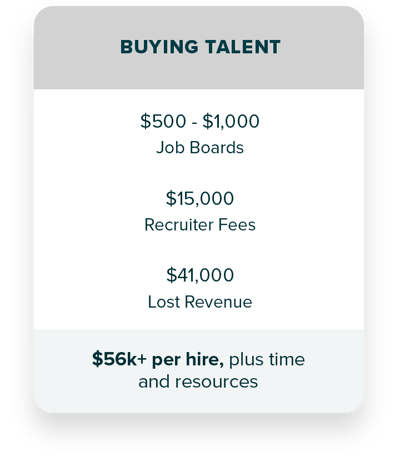

Finding and keeping your star performers is one of the keys to dealership success. Employee turnover, while not currently a notable challenge for automotive retail due to record profitability, is often a barrier to success and a significant dealership expense. Let’s compare the costs between hiring and retaining talent.

The Cost of Buying vs. Building Talent

It is estimated that the cost to recruit a new employee increased to $15,000 in 2022 compared to just $5,000 in 2019. And that doesn’t account for the lost revenue and internal resources that are redirected to reviewing resumes and interviewing during the 30+ days it takes on average to fill that open position. All told, it can cost upwards of $56,000 per hire.

Source: JM&A Group Data

In contrast, building your talent pipeline from within can cost as little as $4,000 per year, taking into account an annual budget of $3,800 per person in training and a few hundred dollars for software licenses. Plus, when you promote from within, you can fill vacancies faster, increase employee loyalty and ensure they’ll be able to jump right in since they’re already familiar with your teams and processes.

A Modern Approach to Dealership Hiring

Relying on a job posting to grab an applicant’s attention is no longer enough for your talent acquisition strategy. Employee recruitment should be viewed in the same way as vehicle sales marketing. By creating a talent funnel and treating the applicant journey like the customer journey, dealers can create a top-notch hiring experience that inspires applicants to choose them over the competition.

PRO TIPS

- If you want your job listing to be seen, utilize multiple channels. Applicants will start their research online, so you should be tracking and measuring those activities like a marketing initiative.

- Hiring great people costs money. Expect to pay for online job posts and promotional services, and include a recruiter in your budget to help discover your ideal candidate.

- Your culture matters to today’s employees. Identify and highlight your employer brand as a key selling point for working with you.

Utilizing a talent optimization platform like The Predictive Index, which takes a scientific approach to people strategy, can be an ideal resource for companies looking to create solid teams, build a noteworthy culture, make objective hiring decisions, foster engagement and inspire greatness.

Focus on Retention to Build an Engaged Workforce

Of course, the work doesn’t end once your new hire is in place. Like any good relationship, that of an employee and employer requires continued commitment and nurturing to build loyalty and sustain an engaged workforce. You have to continue to invest in and develop your team to keep them. To build internal talent, use a comprehensive toolbox of training, skill development opportunities and personalized coaching, or utilize an employee engagement consultant to support the retention process and to best achieve specific business goals.

Creating a solid dealership culture is not an event, it's a daily, intentional effort that requires a lot of hard work and a big investment. People are not only the dealership’s biggest expense, they are the biggest opportunity to help drive performance.

Kevin Hull

Director of Training and Sales

JM&A Group

Create a Talent Program that Lasts

Recruitment and retention goes far beyond a necessary task to keep your dealership running and get tasks completed. Building an effective, lasting talent program can increase productivity, improve customer satisfaction and drive long-term team performance. Growing your dealership for the future requires building your bench of talent, creating specific job targets, preparing rising leaders and aligning teams for collaborative growth.

You don’t have to do it alone. By talking to talent experts and taking a data-backed, innovative approach, you can hold onto top performers and reduce the resource strain on your teams. That means you’ll spend less time hiring and more time growing.

PATHWAY #5

Dealership Insurance Services and Risk Management Consulting

Being proactive and anticipating shifts in the automotive industry is one of the hallmarks of successful dealers. And that extends into how you protect your business, your people and your property. The right mix of insurance and risk management solutions is not only part of a responsible business model, it can also help safeguard your bottom line and help you retain your employees. As much as dealerships re-evaluate their processes when it comes to revenue generation, investing time in reviewing insurance coverage and policies is an often-overlooked area.

PRO TIPS

Taking a holistic approach to insurance means considering:

- Your buildings and their contents

- Your employees and their families

- Your customers

- The vehicles on your lot

Benefits Packages are an Employee Retention Tool

You can make the biggest impact for your business with the plans you offer your employees. A great way to reduce turnover and keep your people engaged is by offering affordable, flexible benefits packages. From 401Ks to health, dental, life and optional coverage plans such as 529 College Plans, you can build a mix that appeals to your dealership teams.

One-on-one employee benefits enrollments can help your teams plan for their health and savings goals, as well as increase overall participation to ensure they have the coverage they need. With options best suited for them, your teams can feel confident taking advantage of comprehensive, competitively priced insurance.

Stress-Free, Comprehensive Dealership Insurance is Possible

The first step is to assess your needs through a comprehensive review of your business, which will help reveal the areas of greatest opportunity to reduce your risk and add necessary coverage. This could include a garage liability policy for vehicles on your lot or upgrading your healthcare and 401k plans to help retain your team members.

By getting coverage for all areas of your dealership from one agent, rather than privately going to market, you increase the likelihood that you’ll be able to keep your coverage consistent from year to year and not pay a premium for it. This stability pays huge dividends for your business and with something even more priceless – your people’s confidence and trust.

Cybersecurity is an Emerging Need for Dealers

One area many dealers overlook is their information security, and how they protect the sensitive data of their business and customers. Cyber risk assessments and insurance policies are a growing area of interest for dealers – and for good reason considering the implications of a data breach.

As dealership tech has become more ingrained in the DMS systems for dealer management, there are more software vendors than ever before. That has created an opportunity for cyber thieves to really prey on dealers. There’s no shortage of new ransomware, all sorts of phishing schemes, hacking schemes.

Elliot Schor

Chief Financial Officer

JM&A Group

Getting a complete picture of your dealership’s needs from agents who specialize in automotive is a great way to assess your overall coverage options. Build a more secure and reliable operation that appeals to your employees and better protects you from risk.

Dealership Trends in a Changing World

The automotive industry will continue to evolve, so now is the time to implement comprehensive solutions to help you stay ahead of the curve and create custom approaches to success based on your individual goals. Growth comes to those who are prepared to adapt and remain agile in a changing world.

Regardless of where the path leads, one constant will always be the need to create and provide truly exceptional customer experiences.

Having the right roadmap, with the best people, processes and products in place, will allow you to navigate the road ahead and deliver on that goal, while also helping to boost your bottom line.

Sources

-

https://www.autonews.com/retail/why-many-ev-buyers-still-prefer-dealerships

-

https://www.autonews.com/guest-commentary/jma-how-dealers-can-adapt-fi-ev-buyers

-

https://www.autonews.com/sponsored/evs-will-drive-changes-fi-products

-

https://www.coxautoinc.com/market-insights/new-vehicle-inventory-september-2022/

-

https://www.wsj.com/articles/strong-new-car-demand-collides-with-rising-interest-rates-11664748444

-

https://publish.manheim.com/content/dam/consulting/ManheimUsedVehicleValueIndex-LineGraph.png

-

https://www.autonews.com/retail/car-dealers-adjust-customers-turn-omnichannel-sales

-

https://www.cbtnews.com/how-dealers-continue-to-compete-in-fi-with-jonathan-jordan-and-kevin-hull/

-

https://www.nada.org/nada/research-and-data/nada-dealership-workforce-study

-

https://www.coxautoinc.com/learning-center/2018-fixed-ops-study/

-

https://jmfamily.com/news/the-predictive-index-secures-investment-from-jm-family/

-

https://www.wardsauto.com/dealers/cybersecurity-stressed-dealerships-bought-sold